Finanzas: Procter & Gamble: From Investors To Consumers

This article has been written by Olivier Gélinas for Dividend Stocks Rock.

Procter & Gamble (PG) is a pillar in its industry and a model for a number of businesses: impressive brand portfolio, strong volume of sales, presence in every market, a CEO’s dream! PG also pleases shareholders in various ways. On top of a well-informed management, the company’s dividend distribution is off the charts. Now, in a 62-year of dividend increases, shareholders are not disappointed by this dividend king. Although the retail industry is starting to face changes, I am not worried for PG. This 65 brands giant knows the market and more importantly, it knows its customers.

Understanding the Business

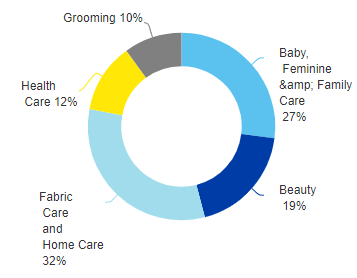

According to Forbes, PG is the world’s largest household and personal care manufacturer. The 180 years old company distributes its many brands in more than 180 countries, generating almost $67B in sales per year. Those sales are coming from its 10 major product categories. Among its numerous brands, we can find the well-known Tide, Downy, Pampers, Bounty, Charmin, Always, Old Spice, and much more.

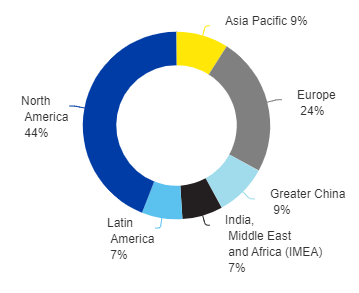

Source: Procter & Gamble’s website – P&G At a glance

Besides its great products variety, PG benefits from a good geographic diversification. Although the company could be focusing on emerging markets in the upcoming years (more on that later), PG is well positioned in its current markets. Of course, behind all of those sales are 92,000 dedicated employees who help smoothing the sailing of the operations.

Growth Vectors

Source: YCharts

Management’s vision of the future is simple but effective. The company has built a tremendous brand portfolio from which basically everyone is finding what it needs. One of its strongest growth vectors is its name itself. By always stepping up its standards, by delivering ever-increasing volumes to retailers and by never letting shelves empty, PG is building a trustworthy bond between every party involved.

Finally, PG’s management has a huge role to play in the company’s brands portfolio. With around 65 different labels, decisions must be made on which ones to keep and which ones to let go. This is crucial if PG wants to keep its operating margins safe. As a result, many segments were sold between 2016 and 2017 in order to achieve such goals.

Latest quarter in a flash

On October 19, the company reported the following results:

- EPS of $1.12, beating estimates by $0.03.

- Reported revenues of $16.69B, a 0.2% increase, beating consensus by $220M.

- Declared dividend of $0.7172/share, a 4% jump compared to last’s year same period.

David Taylor, Chairman and CEO of PG, seemed happy about those figures:

We generated strong consumption, organic volume and organic sales in the first quarter. This keeps us on track to deliver our top- and bottom-line targets for the fiscal year.”

Dividend Growth Perspective

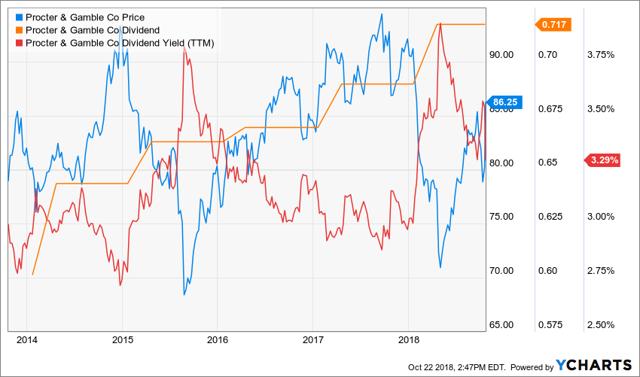

When looking at PG’s dividend history, there are no compromises. A 62-year streak of dividend increases and the dividend king title are indeed impressive. Increases are not the most prominent ones, being in the low to mid-single digits, but this is spot on for a defensive stock.

Source: YCharts

I must admit that defensive consumer stocks are usually not the most attractive in terms of yield. However, the 3%+ mark for this stock is truly pleasing. Considering PG’s growth plan, I don’t see why this figure would dip deep down in the near future.

Source: YCharts

Even if some consider a payout level of 70% a high one, it is quite a normal number in the consumer retail sector. PG’s acquisitions and other investments plans could affect its payout levels, but I don’t see any immediate threats regarding their sustainability.

Potential Downsides

PG’s business is all around the world. With that in mind, lots of concerns arise when thinking about currency exposure. Selling in 180+ countries is time-consuming in terms of hedging activities. With volatility increasing in current markets, it will become a real hassle to correctly and effectively protect those operations from any currency losses.

Another concern on PG’s sales resides in its emerging markets activities. During the last few years, the company was eager to acquire new and innovative products to fulfill customers’ needs, which may not be a bad thing. However, the company’s focus is a little too much on product acquisitions rather than on consolidating its market shares. In the meantime, many smaller companies have taken open market in forgotten regions. While this might not be a big concern for now, PG’s management might consider an intensive marketing campaign, which, in turn, might not fit in its current budget.

Valuation

Trading at approximately 4x its PE ratio, investors should wonder if an investment opportunity still exists.

Source: YCharts

To find out, I am using a dividend discount model. I used an annualized $2.87 dividend payment along with a standard 9% discounting rate. I also set a short run growth of 5% and one of 6% for a longer run.

| Input Descriptions for 15-Cell Matrix | INPUTS | ||

| Enter Recent Annual Dividend Payment: | $2.87 | ||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | ||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | ||

| Enter Discount Rate: | 9.00% | ||

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $167.31 | $111.93 | $84.22 |

| 10% Premium | $153.37 | $102.60 | $77.20 |

| Intrinsic Value | $139.43 | $93.27 | $70.18 |

| 10% Discount | $125.48 | $83.95 | $63.16 |

| 20% Discount | $111.54 | $74.62 | $56.15 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

The intrinsic value given by the model currently suggests that the stock is undervalued. While markets are valuing the stock at around $86 a share, the calculations here would hover around $93. While the difference is highly subject to the model’s inputs, I think investors might have a buying window now.

Final Thought

With everything factored in, I’m really impressed by this retail giant. It showed to its customers a lot of loyalty and will to better suit their needs. Its key metrics are showing great progress, which is telling me that the company should be capitalizing on this momentum in order to gain further market shares.

For investors who are looking for a reliable income at a decent price, I would definitely look into PG’s stock. A 3.2% yielder with such an established business is a win for me. In addition, the management really seems to take the future of the business seriously, which tells me dividend increases should be coming in for many years.

Seriously, if you made it this far, it’s because you liked what you read. Don’t be a stranger; leave a comment and tell me what you think! I’m asking you one more thing; click on “follow” button (it’s orange, you can’t miss it!) and you will get notified each time I write a great piece like this one.

Disclosure: We do hold PG in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Many investors focus on dividend yield or dividend history. I respectfully think they’re making a mistake. While both metrics are important, aiming at companies that have and show the ability to continue raising their dividend by high single-digit to double-digit numbers will make your portfolio outperform others. When a company pushes its dividend so fast, it’s because it is also growing their revenues and earnings. Isn’t this the fundamental of investing – finding strong companies that will grow in the future? If you are looking for a great combination of dividend and growth, check out my picks at Dividend Growth Rocks.

สูตรเซียนบาคาร่า

Hey there, I think your website might be having browser compatibility issues. When I look at your blog in Ie, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, wonderful blog!

7สล็อต

I do agree with all the ideas you have presented in your post. They are really convincing and will certainly work. Still, the posts are too short for beginners. Could you please extend them a little from next time? Thanks for the post.

เว็บยอดเซียน

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get bought an shakiness over that you wish be delivering the following. unwell unquestionably come more formerly again as exactly the same nearly very often inside case you shield this increase.

เว็บคาสิโนออนไลน์ Sexybaccarat

Wow, incredible blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your website is wonderful, let alone the content!

ดูหนังออนไลน์2022

I just wanted to type a note to thank you for all the unique advice you are posting here. My particularly long internet lookup has now been rewarded with high-quality knowledge to talk about with my best friends. I ‘d assert that most of us readers actually are very lucky to live in a fine community with very many lovely individuals with helpful opinions. I feel somewhat blessed to have come across your entire web pages and look forward to plenty of more enjoyable times reading here. Thanks a lot once again for a lot of things.

แทงบาคาร่า ขั้นต่ำ 20 บาท

Hi, i think that i saw you visited my site so i came to “return the favor”.I am trying to find things to improve my site!I suppose its ok to use a few of your ideas!!

หนังใหม่2022

Someone essentially help to make seriously articles I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to make this particular publish incredible. Fantastic job!

บาคาร่า

Youre so cool! I dont suppose Ive learn something like this before. So nice to find any person with some authentic thoughts on this subject. realy thanks for beginning this up. this website is one thing that’s wanted on the internet, somebody with somewhat originality. useful job for bringing something new to the internet!

antage

ventolin ventolin tablet uses best price for ventolin inhaler ventolin 2mg tablet

ทางเข้า PG SLOT สล็อตออนไลน์

Good day! I know this is kinda off topic but I was wondering which blog platform are you using for this website? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at alternatives for another platform. I would be awesome if you could point me in the direction of a good platform.

ทดลองเล่น บาคาร่า SAGAMING

Hey There. I found your blog using msn. This is an extremely well written article. I will make sure to bookmark it and come back to read more of your useful info. Thanks for the post. I’ll certainly comeback.

Best No Credit Check Loans

This is really interesting, You are a very skilled blogger. I’ve joined your rss feed and look forward to seeking more of your wonderful post. Also, I have shared your website in my social networks!

Payday Loans

Greetings from California! I’m bored at work so I decided to check out your blog on my iphone during lunch break. I really like the information you present here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, amazing site!

Payday Loans Near Me

Hi would you mind letting me know which hosting company you’re using? I’ve loaded your blog in 3 completely different internet browsers and I must say this blog loads a lot faster then most. Can you suggest a good hosting provider at a reasonable price? Kudos, I appreciate it!

Payday Loans Near Me

Of course, what a great site and informative posts, I surely will bookmark your website.All the Best!

Payday Loans

Greetings from California! I’m bored to tears at work so I decided to check out your blog on my iphone during lunch break. I love the information you present here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyways, awesome blog!

Best No Credit Check Loans

Magnificent items from you, man. I’ve understand your stuff previous to and you’re simply too magnificent. I really like what you have obtained here, certainly like what you are stating and the way in which wherein you are saying it. You are making it enjoyable and you continue to care for to keep it sensible. I can not wait to read far more from you. That is actually a tremendous site.

Loans Near Me with Bad Credit

Heya i am for the primary time here. I came across this board and I in finding It really helpful & it helped me out much. I am hoping to give one thing back and help others such as you helped me.

Payday Loans Near Me

certainly like your web-site however you need to take a look at the spelling on several of your posts. Many of them are rife with spelling issues and I in finding it very bothersome to inform the truth nevertheless I’ll certainly come again again.

Loans Near Me with Bad Credit

Fantastic beat ! I would like to apprentice while you amend your site, how could i subscribe for a blog website? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear idea

$5,000 Loan No Credit Check

Great website. Plenty of helpful information here. I am sending it to several pals ans also sharing in delicious. And naturally, thank you in your sweat!

Payday Loans

A person essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to create this particular publish extraordinary. Excellent job!

Payday Loans

This website is really a stroll-by way of for all of the data you wished about this and didn’t know who to ask. Glimpse right here, and also you’ll undoubtedly discover it.

5000 loan with no credit

I used to be more than happy to seek out this internet-site.I needed to thanks in your time for this glorious learn!! I positively enjoying each little little bit of it and I have you bookmarked to take a look at new stuff you blog post.

loans 5000 no credit check

You completed a few fine points there. I did a search on the subject and found a good number of persons will go along with with your blog.

Payday Loans

At this time it sounds like Movable Type is the best blogging platform out there right now. (from what I’ve read) Is that what you are using on your blog?

5000 loan no credit check

Hey There. I found your blog the usage of msn. That is an extremely well written article. I’ll make sure to bookmark it and come back to learn more of your useful information. Thanks for the post. I will definitely return.

payday loan with check stub

I just couldn’t go away your site prior to suggesting that I actually enjoyed the standard information a person provide for your visitors? Is gonna be again ceaselessly in order to inspect new posts

24 hour loans no credit check

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your webpage? My website is in the exact same niche as yours and my visitors would genuinely benefit from some of the information you provide here. Please let me know if this alright with you. Cheers!

muckEror

priligy http://dapoxe.com/ priligy testimonials priligy dapoxetina cvs

loans 5000 no credit check

Its like you read my thoughts! You seem to grasp a lot about this, like you wrote the ebook in it or something. I feel that you just could do with a few percent to power the message home a bit, but other than that, this is magnificent blog. An excellent read. I will certainly be back.

เว็บพนันออนไลน์ที่ดีที่สุด 2022

Once I initially commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the identical comment. Is there any manner you possibly can take away me from that service? Thanks!

สล็อต pg slot สูตรเด็ด

Greetings from Carolina! I’m bored to tears at work so I decided to check out your website on my iphone during lunch break. I love the info you provide here and can’t wait to take a look when I get home. I’m shocked at how fast your blog loaded on my phone .. I’m not even using WIFI, just 3G .. Anyhow, great blog!

สล็อต pg slot สูตรเด็ด

Great goods from you, man. I have understand your stuff previous to and you are just extremely wonderful. I actually like what you have acquired here, certainly like what you are saying and the way in which you say it. You make it enjoyable and you still take care of to keep it sensible. I cant wait to read far more from you. This is actually a wonderful site.

สูตรสล็อต pg สล็อต แตกง่าย

I appreciate, cause I found just what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

เว็บพนันออนไลน์เว็บตรง

Valuable information. Lucky me I found your website by accident, and I’m shocked why this accident did not happened earlier! I bookmarked it.

เกมยิงปลาฟรี

I think other web site proprietors should take this website as an model, very clean and fantastic user friendly style and design, as well as the content. You’re an expert in this topic!

เกมยิงปลาฟรี

Good – I should definitely pronounce, impressed with your website. I had no trouble navigating through all tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, website theme . a tones way for your customer to communicate. Nice task..

เว็บพนัน บาค่าร่า

Good write-up, I am regular visitor of one’s website, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

สูตรสล็อต pg

Please let me know if you’re looking for a article author for your weblog. You have some really good articles and I think I would be a good asset. If you ever want to take some of the load off, I’d really like to write some articles for your blog in exchange for a link back to mine. Please blast me an email if interested. Kudos!

ufabet ทางเข้า

Valuable information. Lucky me I found your website by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

สมัคร เว็บแทงบอลออนไลน์

Hello. magnificent job. I did not imagine this. This is a remarkable story. Thanks!

ทางเข้า ufabet888

I savour, cause I discovered exactly what I was taking a look for. You have ended my four day lengthy hunt! God Bless you man. Have a great day. Bye

ufabet เว็บตรงทางเข้า มือถือ

I’m really loving the theme/design of your blog. Do you ever run into any browser compatibility issues? A couple of my blog audience have complained about my website not operating correctly in Explorer but looks great in Chrome. Do you have any solutions to help fix this problem?

ufabet เว็บตรงทางเข้า มือถือ

Its like you read my mind! You seem to know a lot about this, like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a bit, but other than that, this is excellent blog. A fantastic read. I will certainly be back.

ทางเข้า ufabet777

I am not sure where you are getting your info, but good topic. I needs to spend some time learning much more or understanding more. Thanks for wonderful info I was looking for this info for my mission.

ทางเข้า ufabet191

It is really a great and helpful piece of information. I am glad that you shared this useful info with us. Please keep us informed like this. Thank you for sharing.

เว็บแม่ สล็อต

The other day, while I was at work, my sister stole my iphone and tested to see if it can survive a twenty five foot drop, just so she can be a youtube sensation. My apple ipad is now destroyed and she has 83 views. I know this is entirely off topic but I had to share it with someone!

24 hour loan approval

I loved as much as you will obtain performed proper here. The cartoon is attractive, your authored subject matter stylish. however, you command get bought an impatience over that you want be delivering the following. in poor health indubitably come further earlier once more since exactly the same nearly a lot often inside case you defend this hike.

ufabet เข้าสู่ระบบ

Currently it appears like Movable Type is the preferred blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

24 hour loans no credit check

Do you have a spam issue on this blog; I also am a blogger, and I was curious about your situation; many of us have developed some nice methods and we are looking to exchange solutions with other folks, please shoot me an email if interested.

หนังออนไลน์ 2022 พากย์ไทย ไม่มี โฆษณา

You can certainly see your enthusiasm in the paintings you write. The arena hopes for even more passionate writers like you who aren’t afraid to say how they believe. At all times go after your heart.

sports betting

Thank you for another informative web site. Where else could I get that kind of information written in such a perfect way? I have a project that I’m just now working on, and I’ve been on the look out for such information.

ดูหนังออนไลน์

Its such as you read my mind! You seem to grasp so much about this, such as you wrote the book in it or something. I think that you simply can do with some p.c. to pressure the message home a little bit, but instead of that, that is magnificent blog. A great read. I will certainly be back.

sports betting apps

It’s actually a great and useful piece of info. I’m glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

24 hour loan bad credit

I’m really impressed with your writing skills as smartly as with the structure for your weblog. Is this a paid topic or did you modify it your self? Anyway keep up the excellent quality writing, it is rare to peer a nice weblog like this one today..

payday loan with check stub

I was wondering if you ever thought of changing the layout of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 images. Maybe you could space it out better?

sports betting apps

I have read some good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to create such a wonderful informative web site.

หนังออนไลน์ 2022 พากย์ไทยเต็มเรื่อง

Hello there, just changed into alert to your blog through Google, and found that it is really informative. I am going to be careful for brussels. I’ll be grateful in case you continue this in future. Lots of other folks will likely be benefited from your writing. Cheers!

loans near me with bad credit

Simply desire to say your article is as surprising. The clarity to your submit is just great and i can assume you are an expert on this subject. Well together with your permission allow me to clutch your feed to stay updated with imminent post. Thanks one million and please continue the gratifying work.

$5,000 loan no credit check

Once I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a comment is added I get 4 emails with the identical comment. Is there any manner you possibly can remove me from that service? Thanks!

หนังใหม่ชนโรง 2022

I’m so happy to read this. This is the type of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this greatest doc.

เว็บพนันแทงบอลออนไลน์

It’s laborious to find knowledgeable individuals on this subject, however you sound like you realize what you’re talking about! Thanks

ufabet สล็อต เว็บตรง

Youre so cool! I dont suppose Ive learn something like this before. So nice to seek out anyone with some unique ideas on this subject. realy thanks for beginning this up. this web site is one thing that’s wanted on the net, somebody with a bit originality. useful job for bringing one thing new to the web!

ดูซีรี่ย์ออนไลน์ฟรี 2022

It is really a great and helpful piece of information. I am glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

เว็บพนันออนไลน์เว็บตรง

I’m not that much of a online reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. Many thanks

หนังใหม่ 2022

Pretty section of content. I just stumbled upon your blog and in accession capital to assert that I acquire actually enjoyed account your blog posts. Anyway I will be subscribing to your augment and even I achievement you access consistently rapidly.

สล็อต

Good day! This is my first comment here so I just wanted to give a quick shout out and tell you I truly enjoy reading through your articles. Can you suggest any other blogs/websites/forums that deal with the same subjects? Thanks a ton!

สูตรสล็อต pg แตกง่าย

Thank you a lot for sharing this with all folks you really understand what you’re speaking about! Bookmarked. Kindly additionally seek advice from my website =). We may have a link trade agreement among us!

betflix สมัคร

A person essentially help to make seriously posts I would state. This is the first time I frequented your website page and thus far? I surprised with the research you made to create this particular publish extraordinary. Great job!

สูตรสล็อต pg ฟรี

You could definitely see your expertise in the work you write. The world hopes for even more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.

เว็บ7เซียน

whoah this blog is magnificent i love reading your articles. Keep up the great work! You know, lots of people are searching around for this information, you could aid them greatly.

เซียนคาสิโน

Hello, Neat post. There is a problem along with your web site in internet explorer, might check this… IE still is the marketplace chief and a good section of other folks will pass over your excellent writing due to this problem.

Cash App Loan 2022

I simply couldn’t go away your website before suggesting that I extremely enjoyed the usual information an individual provide on your visitors? Is gonna be again continuously in order to investigate cross-check new posts

Cash App Loan Today

I’m not sure where you’re getting your information, but great topic. I needs to spend some time learning more or understanding more. Thanks for excellent information I was looking for this info for my mission.

Cash App Loan Application

I wish to show my thanks to this writer just for rescuing me from this particular matter. As a result of browsing through the search engines and getting suggestions which are not productive, I believed my life was over. Being alive without the solutions to the difficulties you have solved as a result of the write-up is a critical case, and the ones which could have adversely affected my career if I had not encountered your site. Your own personal skills and kindness in taking care of every item was invaluable. I am not sure what I would’ve done if I hadn’t come upon such a step like this. It’s possible to at this point look ahead to my future. Thank you very much for this skilled and results-oriented help. I won’t think twice to suggest the sites to anyone who ought to have guidelines about this area.

$100 Loan Instant App

Hey there! I know this is kinda off topic however I’d figured I’d ask. Would you be interested in trading links or maybe guest authoring a blog article or vice-versa? My site discusses a lot of the same topics as yours and I believe we could greatly benefit from each other. If you are interested feel free to send me an email. I look forward to hearing from you! Great blog by the way!

Cash App Advance Loan

There are some interesting deadlines on this article but I don’t know if I see all of them middle to heart. There may be some validity however I will take maintain opinion till I look into it further. Good article , thanks and we would like more! Added to FeedBurner as well

Cash App Loan 2022

Definitely imagine that that you stated. Your favorite reason seemed to be on the internet the easiest thing to consider of. I say to you, I definitely get annoyed whilst other folks think about worries that they plainly don’t understand about. You controlled to hit the nail upon the highest and also outlined out the whole thing with no need side effect , other folks can take a signal. Will probably be again to get more. Thanks

สูตร pg slot

Of course, what a magnificent website and educative posts, I will bookmark your website.All the Best!

หนังใหม่ 2022

Hello! I could have sworn I’ve been to this site before but after browsing through some of the post I realized it’s new to me. Anyhow, I’m definitely delighted I found it and I’ll be book-marking and checking back often!

หนังออนไลน์ 2022 พากย์ไทย ไม่มี โฆษณา

The subsequent time I read a blog, I hope that it doesnt disappoint me as a lot as this one. I imply, I do know it was my choice to read, but I really thought youd have one thing fascinating to say. All I hear is a bunch of whining about one thing that you can repair if you werent too busy on the lookout for attention.

หนังใหม่2022พากย์ไทย

I have been exploring for a little bit for any high quality articles or weblog posts on this kind of house . Exploring in Yahoo I finally stumbled upon this site. Reading this information So i’m happy to convey that I have an incredibly just right uncanny feeling I found out just what I needed. I such a lot for sure will make certain to do not disregard this website and give it a look on a relentless basis.

Stooma

dapoxetine amazon priligy priligy dapoxetine buy priligy cheap

หนังใหม่

Somebody necessarily assist to make seriously articles I might state. That is the first time I frequented your website page and up to now? I amazed with the analysis you made to make this actual post incredible. Wonderful process!

Donaldillic

styplon 30 tabs https://candipharm.com/search?text=styplon_30_tabs

หนังออนไลน์

I have been exploring for a bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this information So i’m happy to convey that I have an incredibly good uncanny feeling I discovered exactly what I needed. I most certainly will make sure to do not forget this site and give it a look on a constant basis.

หนังใหม่

hello!,I like your writing very much! share we communicate more about your article on AOL? I require an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

betflix เว็บตรง

Good web site! I really love how it is easy on my eyes and the data are well written. I’m wondering how I could be notified when a new post has been made. I have subscribed to your RSS feed which must do the trick! Have a nice day!

pg slot

I have been exploring for a bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this info So i am happy to convey that I’ve a very good uncanny feeling I discovered exactly what I needed. I most certainly will make certain to do not forget this website and give it a look regularly.

สูตรสล็อต pg ฟรี

My brother suggested I might like this website. He was totally right. This post truly made my day. You can not imagine just how much time I had spent for this information! Thanks!

betflix

Thank you, I’ve recently been looking for info about this topic for ages and yours is the best I have discovered till now. But, what about the conclusion? Are you sure about the source?

สล็อต

I do agree with all of the ideas you’ve presented in your post. They are really convincing and will definitely work. Still, the posts are too short for starters. Could you please extend them a bit from next time? Thanks for the post.

ยอดเซียนสล็อต

This design is incredible! You definitely know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Great job. I really loved what you had to say, and more than that, how you presented it. Too cool!

joker123

I am not sure where you are getting your information, but great topic. I needs to spend some time learning more or understanding more. Thanks for fantastic info I was looking for this information for my mission.

คาสิโนออนไลน์เว็บตรง

you’re really a good webmaster. The web site loading speed is amazing. It seems that you’re doing any unique trick. Moreover, The contents are masterwork. you’ve done a great job on this topic!

pg slot

Hey there! I know this is somewhat off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

sports betting apps

Thanks a lot for providing individuals with such a splendid possiblity to read articles and blog posts from this blog. It can be very pleasing and also full of amusement for me and my office acquaintances to visit your blog not less than thrice weekly to find out the latest tips you have. And indeed, I am usually astounded with all the staggering advice you serve. Selected 3 facts in this posting are really the most beneficial we have had.

sports betting apps

Hey, you used to write magnificent, but the last several posts have been kinda boring… I miss your great writings. Past several posts are just a little bit out of track! come on!

คาสิโนออนไลน์เว็บตรง

Hello.This article was really remarkable, especially because I was searching for thoughts on this subject last Saturday.

สล็อต ufabet เว็บตรง

I do enjoy the manner in which you have framed this problem and it really does offer me personally a lot of fodder for thought. On the other hand, from just what I have experienced, I simply just hope as the commentary pack on that men and women remain on point and in no way start on a tirade associated with the news of the day. All the same, thank you for this superb piece and while I do not necessarily concur with it in totality, I value the perspective.

ufabet thai

I do agree with all of the ideas you’ve offered in your post. They are really convincing and can certainly work. Still, the posts are very brief for newbies. May you please prolong them a bit from subsequent time? Thank you for the post.

ufabet 100

You could certainly see your enthusiasm within the work you write. The world hopes for more passionate writers like you who are not afraid to say how they believe. Always follow your heart.

ufabet 999

As a Newbie, I am permanently exploring online for articles that can aid me. Thank you

ufabet 363

I am just writing to let you know what a exceptional experience my cousin’s child went through browsing your webblog. She noticed numerous pieces, which include what it’s like to have an excellent helping heart to get the rest without difficulty know precisely certain very confusing issues. You truly exceeded my expectations. Thanks for providing such good, safe, explanatory and fun tips on your topic to Mary.

สล็อต ufabet เว็บตรง

Wonderful goods from you, man. I have understand your stuff previous to and you are just too great. I really like what you have acquired here, certainly like what you are stating and the way in which you say it. You make it entertaining and you still take care of to keep it wise. I can’t wait to read much more from you. This is really a terrific site.

betflix สมัคร

I carry on listening to the news bulletin speak about getting free online grant applications so I have been looking around for the best site to get one. Could you tell me please, where could i find some?

ufabet gg

Hello! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My site looks weird when browsing from my apple iphone. I’m trying to find a theme or plugin that might be able to correct this issue. If you have any recommendations, please share. Cheers!

สล็อต7

Wow! This could be one particular of the most beneficial blogs We have ever arrive across on this subject. Actually Great. I’m also a specialist in this topic therefore I can understand your effort.

betflix สมัคร

Hi, i feel that i saw you visited my weblog so i came to “return the want”.I’m attempting to in finding things to improve my website!I assume its ok to make use of a few of your concepts!!

หนังใหม่2022พากย์ไทย

Youre so cool! I dont suppose Ive learn anything like this before. So nice to seek out any person with some original thoughts on this subject. realy thank you for beginning this up. this web site is something that’s needed on the web, somebody with a little originality. helpful job for bringing one thing new to the web!

ดูซีรี่ย์ออนไลน์ฟรี 2022

Very nice info and right to the point. I don’t know if this is actually the best place to ask but do you people have any thoughts on where to get some professional writers? Thanks in advance 🙂

หนังใหม่2022

Hi! This post could not be written any better! Reading this post reminds me of my good old room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thanks for sharing!

หนังออนไลน์ 2022 พากย์ไทย ไม่มี โฆษณา

Very nice article and straight to the point. I don’t know if this is truly the best place to ask but do you people have any ideea where to hire some professional writers? Thanks in advance 🙂

หนังออนไลน์ 2022 พากย์ไทยเต็มเรื่อง

I’ve been browsing online more than three hours nowadays, but I never found any attention-grabbing article like yours. It is lovely value sufficient for me. In my opinion, if all site owners and bloggers made excellent content as you probably did, the internet might be much more helpful than ever before.

ดูหนังออนไลน์ใหม่

I’ve been exploring for a little bit for any high quality articles or blog posts on this sort of space . Exploring in Yahoo I eventually stumbled upon this web site. Studying this info So i am glad to exhibit that I have a very just right uncanny feeling I discovered exactly what I needed. I most unquestionably will make certain to do not disregard this website and give it a glance regularly.

ufabet boss369

Excellent blog here! Also your site loads up fast! What host are you using? Can I get your affiliate link to your host? I wish my website loaded up as fast as yours lol

เว็บพนันออนไลน์เว็บตรง

Hi there, I found your site by the use of Google while searching for a similar matter, your web site got here up, it appears good. I have bookmarked it in my google bookmarks.

ufa888 เว็บตรง

hi!,I love your writing so much! proportion we be in contact extra approximately your post on AOL? I require a specialist on this area to solve my problem. May be that is you! Looking ahead to see you.

ดูซีรีย์ออนไลน์

Nearly all of what you say happens to be supprisingly accurate and it makes me ponder the reason why I hadn’t looked at this in this light previously. This particular piece truly did turn the light on for me as far as this specific issue goes. But there is 1 factor I am not really too comfortable with and while I attempt to reconcile that with the central idea of your position, allow me see just what all the rest of your visitors have to point out.Very well done.

ufabet สล็อต เว็บตรง

I like what you guys are up also. Such smart work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

ufabet สล็อต เว็บตรง

Just wish to say your article is as astonishing. The clarity on your publish is simply cool and i could think you’re knowledgeable on this subject. Fine with your permission let me to take hold of your feed to keep updated with impending post. Thank you one million and please continue the rewarding work.

เว็บดูหนังออนไลน์

In the great design of things you actually secure a B- just for effort. Where exactly you actually lost me personally was in the specifics. You know, it is said, details make or break the argument.. And it could not be more correct right here. Having said that, permit me inform you precisely what did work. The writing can be quite convincing and that is most likely the reason why I am taking an effort in order to opine. I do not make it a regular habit of doing that. Next, while I can see the jumps in reason you come up with, I am not necessarily sure of how you appear to unite the ideas which inturn make the conclusion. For now I will, no doubt subscribe to your point but hope in the near future you actually link the dots better.

ดูหนังฟรี

Great post. I was checking continuously this weblog and I’m inspired! Extremely useful info specially the last part 🙂 I handle such info much. I used to be seeking this particular information for a very long time. Thanks and best of luck.

ดูหนังออนไลน์

Thanks for another fantastic article. Where else could anybody get that type of information in such an ideal way of writing? I’ve a presentation next week, and I’m on the look for such information.

ดูหนังฟรี

Thanks for your whole efforts on this web site. My mother enjoys setting aside time for investigation and it is easy to understand why. Most of us hear all of the compelling ways you present simple guidelines on the blog and as well invigorate participation from some others on that topic so our favorite child is certainly starting to learn so much. Take advantage of the rest of the new year. You’re the one doing a fantastic job.

เว็บดูหนังออนไลน์ฟรี

you are really a good webmaster. The web site loading speed is amazing. It seems that you are doing any unique trick. Moreover, The contents are masterpiece. you’ve done a great job on this topic!

เว็บดูหนังออนไลน์ฟรี

Wow! This could be one particular of the most beneficial blogs We’ve ever arrive across on this subject. Basically Fantastic. I’m also an expert in this topic so I can understand your effort.

ดูซีรีย์ออนไลน์

I think other website proprietors should take this site as an model, very clean and great user friendly style and design, let alone the content. You are an expert in this topic!

ดูหนังฟรี

I’m just writing to make you know of the superb encounter my cousin’s child went through viewing your webblog. She learned many issues, not to mention how it is like to possess a very effective helping mindset to have many others just learn specific tricky things. You really did more than my expected results. Thank you for providing these warm and helpful, trustworthy, explanatory not to mention unique guidance on that topic to Julie.

ดูหนังฟรี

Very good blog! Do you have any helpful hints for aspiring writers? I’m planning to start my own blog soon but I’m a little lost on everything. Would you recommend starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any ideas? Thanks a lot!

เว็บดูหนังฟรี

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thx again

หนังออนไลน์

Hmm it appears like your blog ate my first comment (it was extremely long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to the whole thing. Do you have any recommendations for inexperienced blog writers? I’d really appreciate it.

เว็บดูหนังออนไลน์ฟรี

Spot on with this write-up, I truly think this web site needs way more consideration. I’ll in all probability be again to learn way more, thanks for that info.

หนังออนไลน์

Hmm it looks like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new to everything. Do you have any tips for newbie blog writers? I’d genuinely appreciate it.

ดูหนังออนไลน์

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the same comment. Is there any way you can remove me from that service? Thank you!

เว็บดูหนังออนไลน์

Thanks for sharing excellent informations. Your website is very cool. I’m impressed by the details that you’ve on this web site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for extra articles. You, my pal, ROCK! I found just the info I already searched all over the place and simply couldn’t come across. What a great website.

เว็บดูหนังฟรี

I was very pleased to find this net-site.I needed to thanks in your time for this glorious read!! I undoubtedly enjoying every little little bit of it and I have you bookmarked to take a look at new stuff you weblog post.

หนังใหม่พากย์ไทย

Hello there, just became alert to your blog through Google, and found that it’s really informative. I’m gonna watch out for brussels. I will be grateful if you continue this in future. Many people will be benefited from your writing. Cheers!

หนังออนไลน์ 2022

I am not sure where you are getting your information, but great topic. I needs to spend some time learning more or understanding more. Thanks for great information I was looking for this info for my mission.

หนังใหม่ 2022

Hey this is kind of of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding experience so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

หนังใหม่

As a Newbie, I am always exploring online for articles that can aid me. Thank you

betflix สมัคร

Thanks a bunch for sharing this with all folks you really understand what you are talking about! Bookmarked. Kindly also discuss with my web site =). We can have a hyperlink change agreement among us!

betflix สมัคร

Hey There. I found your blog using msn. This is an extremely well written article. I’ll be sure to bookmark it and come back to read more of your useful info. Thanks for the post. I will definitely comeback.

ดูหนังออนไลน์

I like the helpful info you provide in your articles. I’ll bookmark your weblog and check again here frequently. I’m quite sure I’ll learn a lot of new stuff right here! Best of luck for the next!

เว็บดูหนังออนไลน์

I’ll immediately grab your rss as I can’t find your e-mail subscription link or e-newsletter service. Do you have any? Please let me know so that I could subscribe. Thanks.

สูตรบาคาร่าฟรี

I am now not positive the place you are getting your info, but great topic. I needs to spend some time learning more or understanding more. Thanks for fantastic information I used to be looking for this info for my mission.

joker123

Hey There. I found your blog using msn. This is a very well written article. I’ll make sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will definitely comeback.

ยูฟ่าสล็อตเว็บตรง

Hi there! I just wanted to ask if you ever have any issues with hackers? My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no backup. Do you have any solutions to stop hackers?

เว็บยูฟ่าที่ดีที่สุด

Thanks for another informative blog. Where else could I get that type of information written in such a perfect way? I have a project that I am just now working on, and I have been on the look out for such information.

คาสิโนออนไลน์เว็บตรง

whoah this weblog is excellent i love reading your articles. Stay up the great paintings! You already know, many people are hunting round for this info, you could help them greatly.

RV Repair Shop Near My Location

Good write-up. I certainly appreciate this website. Continue the good work!

7zean สูตร

Hi! Would you mind if I share your blog with my zynga group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Cheers

สูตรสล็อต pg ฟรี

Hi there would you mind letting me know which web host you’re working with? I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a lot faster then most. Can you suggest a good web hosting provider at a fair price? Thanks a lot, I appreciate it!

เซียนคาสิโน

Hi there! This is kind of off topic but I need some advice from an established blog. Is it tough to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about setting up my own but I’m not sure where to start. Do you have any tips or suggestions? Many thanks

slot online

Great – I should definitely pronounce, impressed with your website. I had no trouble navigating through all the tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your customer to communicate. Nice task..

betflix

Your home is valueble for me. Thanks!…

เว็บยอดเซียน

Good day! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really appreciate your content. Please let me know. Thanks

betflix สมัคร

As a Newbie, I am continuously exploring online for articles that can help me. Thank you

เว็บยูฟ่าที่ดีที่สุด

Generally I do not read post on blogs, but I would like to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, very nice post.

แจกสูตร สล็อต pg ฟรี สล็อต แตกง่าย

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Exceptional work!

เว็บพนันออนไลน์auto

Wow that was strange. I just wrote an really long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say great blog!

หนังใหม่ 2022 เต็มเรื่องพากย์ไทยชนโรง หนังใหม่

fantastic post, very informative. I wonder why the other specialists of this sector don’t notice this. You should continue your writing. I am confident, you have a huge readers’ base already!

หนังออนไลน์ 2022 พากย์ไทยเต็มเรื่อง

Howdy! This is my first visit to your blog! We are a collection of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information to work on. You have done a marvellous job!

หนังใหม่2022พากย์ไทย

Heya i’m for the primary time here. I found this board and I to find It truly useful & it helped me out a lot. I am hoping to give something back and help others like you helped me.

หนังออนไลน์

An attention-grabbing discussion is value comment. I think that you should write extra on this matter, it may not be a taboo subject however typically persons are not enough to talk on such topics. To the next. Cheers

หนังออนไลน์ 2022 พากย์ไทย 4k

Cool blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple tweeks would really make my blog shine. Please let me know where you got your design. Thanks

เว็บพนันออนไลน์auto

Great post. I used to be checking constantly this blog and I am impressed! Extremely helpful information specially the closing part 🙂 I handle such info a lot. I was seeking this certain info for a long time. Thank you and best of luck.

ufabet สล็อต เว็บตรง

I simply needed to say thanks again. I’m not certain what I could possibly have worked on in the absence of these suggestions revealed by you concerning this field. It has been the terrifying problem in my view, however , being able to view a new expert avenue you solved it took me to cry over joy. Now i am happy for the support and thus hope that you recognize what an amazing job you are always doing training others all through your web page. I’m certain you haven’t come across any of us.

เว็บพนันออนไลน์ ไม่ผ่านเอเย่นต์

I think this is one of the so much important info for me. And i’m happy studying your article. But should statement on some common things, The site style is perfect, the articles is in reality great : D. Just right task, cheers

RV Repair

Everything is very open with a very clear explanation of the issues. It was truly informative. Your website is very helpful. Many thanks for sharing!

เว็บพนันออนไลน์เว็บตรง

Hi my friend! I wish to say that this post is awesome, great written and include almost all significant infos. I’d like to peer more posts like this .

สล็อต

I’d should test with you here. Which is not something I usually do! I get pleasure from reading a publish that will make people think. Also, thanks for allowing me to remark!

inpurne

best price for generic cialis How has life changed

หนังออนไลน์ 2022

What’s Happening i’m new to this, I stumbled upon this I have found It absolutely useful and it has helped me out loads. I hope to contribute & assist other users like its helped me. Good job.

เว็บพนันออนไลน์ เว็บตรงไม่ผ่านเอเย่นต์

Great blog here! Additionally your web site a lot up very fast! What web host are you using? Can I get your affiliate hyperlink on your host? I want my site loaded up as fast as yours lol

ufabet เว็บตรง

Does your website have a contact page? I’m having trouble locating it but, I’d like to send you an e-mail. I’ve got some ideas for your blog you might be interested in hearing. Either way, great site and I look forward to seeing it grow over time.

คาสิโนออนไลน์เว็บตรง

I was suggested this blog by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You are incredible! Thanks!

สูตรสล็อต pg สล็อต แตกง่าย

Aw, this was a very nice post. In idea I want to put in writing like this moreover – taking time and precise effort to make an excellent article… but what can I say… I procrastinate alot and under no circumstances seem to get something done.

betflix joker casino

Do you have a spam issue on this website; I also am a blogger, and I was curious about your situation; we have developed some nice practices and we are looking to swap techniques with other folks, why not shoot me an e-mail if interested.

สูตรสล็อต pg แตกง่าย

Thanks for the update, how can I make is so that I receive an email every time there is a new update?

ยอดเซียนสล็อต

Keep working ,great job!

ยอดเซียน slot

It’s actually a great and useful piece of information. I am happy that you just shared this useful info with us. Please stay us up to date like this. Thanks for sharing.

คาสิโน7

It’s really a great and helpful piece of info. I’m happy that you simply shared this useful information with us. Please stay us informed like this. Thanks for sharing.

เว็บ แทง บอล 7

I used to be very happy to find this internet-site.I wanted to thanks on your time for this excellent learn!! I undoubtedly having fun with each little little bit of it and I’ve you bookmarked to take a look at new stuff you blog post.

pg slot

great post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m sure, you have a huge readers’ base already!

สล็อตยอดเซียน

Hello. remarkable job. I did not imagine this. This is a great story. Thanks!

betflix

Wow that was unusual. I just wrote an really long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyway, just wanted to say wonderful blog!

rv body repair near me

Excellent article. I am experiencing some of these issues as well..

สูตรเซียนบาคาร่า

Your home is valueble for me. Thanks!…

ufabet zeed

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say fantastic blog!

ufabet login

Can I just say what a relief to search out somebody who truly knows what theyre talking about on the internet. You positively know learn how to convey an issue to mild and make it important. Extra individuals need to learn this and understand this facet of the story. I cant imagine youre not more standard because you positively have the gift.

ufabet true wallet

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is fundamental and everything. But think about if you added some great pictures or video clips to give your posts more, “pop”! Your content is excellent but with pics and clips, this website could definitely be one of the greatest in its niche. Very good blog!

rv electrical repair near me

I like looking through a post that can make men and women think. Also, many thanks for allowing me to comment!

open sprinter repair near me

When I originally left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I get 4 emails with the exact same comment. Is there an easy method you are able to remove me from that service? Thank you!

7zean

Hello, I think your blog might be having browser compatibility issues. When I look at your website in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, great blog!

สล็อต

This is very attention-grabbing, You’re an overly professional blogger. I’ve joined your rss feed and stay up for seeking more of your great post. Also, I’ve shared your website in my social networks!

เซียนคาสิโน

Hi, Neat post. There’s a problem with your website in internet explorer, would test this… IE still is the market leader and a big portion of people will miss your excellent writing due to this problem.

rv repair shop lake balboa california

Next time I read a blog, I hope that it won’t fail me just as much as this one. After all, I know it was my choice to read through, however I genuinely believed you would have something helpful to talk about. All I hear is a bunch of complaining about something you could possibly fix if you weren’t too busy looking for attention.

motorhome blinds repair near me

Good write-up. I certainly love this site. Keep writing!

สูตรเกมสล็อตpg

Hello there, just became aware of your blog through Google, and found that it is truly informative. I am going to watch out for brussels. I will be grateful if you continue this in future. A lot of people will be benefited from your writing. Cheers!

camper van vinyl wrap replacement

I blog often and I seriously thank you for your content. This article has really peaked my interest. I will bookmark your site and keep checking for new information about once per week. I subscribed to your RSS feed too.

คาสิโน7

Hello, you used to write wonderful, but the last few posts have been kinda boring… I miss your great writings. Past few posts are just a bit out of track! come on!

rv repair shop signal hill california

Everything is very open with a clear clarification of the challenges. It was definitely informative. Your website is useful. Thanks for sharing!

pg slot

Thanks a bunch for sharing this with all of us you really know what you’re talking about! Bookmarked. Kindly also visit my site =). We could have a link exchange contract between us!

ยอดเซียนสล็อต

hey there and thank you for your information – I’ve certainly picked up anything new from right here. I did however expertise some technical points using this site, as I experienced to reload the web site many times previous to I could get it to load correctly. I had been wondering if your web hosting is OK? Not that I am complaining, but slow loading instances times will often affect your placement in google and could damage your high-quality score if advertising and marketing with Adwords. Well I am adding this RSS to my email and can look out for a lot more of your respective intriguing content. Ensure that you update this again soon..

เซียนคาสิโน

There are some interesting cut-off dates in this article but I don’t know if I see all of them center to heart. There is some validity but I’ll take maintain opinion till I look into it further. Good article , thanks and we want more! Added to FeedBurner as effectively

เว็บยอดเซียน

Hey there! Do you use Twitter? I’d like to follow you if that would be ok. I’m absolutely enjoying your blog and look forward to new posts.

สูตร pg slot

I have read several excellent stuff here. Certainly value bookmarking for revisiting. I wonder how a lot effort you place to create one of these wonderful informative site.

closest sprinter repair to me

Having read this I believed it was very enlightening. I appreciate you spending some time and effort to put this content together. I once again find myself spending a significant amount of time both reading and posting comments. But so what, it was still worth it!

เซียนคาสิโน

Pretty great post. I just stumbled upon your blog and wished to say that I’ve truly loved browsing your weblog posts. After all I will be subscribing in your feed and I hope you write once more very soon!

สูตรเกมสล็อตpg

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and all. Nevertheless think of if you added some great graphics or videos to give your posts more, “pop”! Your content is excellent but with images and clips, this blog could undeniably be one of the very best in its field. Very good blog!

7zean สูตร

Do you have a spam issue on this blog; I also am a blogger, and I was wanting to know your situation; many of us have created some nice methods and we are looking to swap solutions with other folks, why not shoot me an email if interested.

best motorhome

Greetings, I do believe your website could possibly be having internet browser compatibility issues. When I take a look at your website in Safari, it looks fine however, if opening in Internet Explorer, it has some overlapping issues. I simply wanted to give you a quick heads up! Aside from that, fantastic blog!

camper floor repair

Good info. Lucky me I recently found your site by chance (stumbleupon). I have saved as a favorite for later!

nearest sprinter to my current location

Itís difficult to find experienced people about this subject, however, you seem like you know what youíre talking about! Thanks

rv repair shop san gabriel california

There is certainly a great deal to learn about this topic. I like all the points you made.

nearby rv repair

Right here is the right web site for everyone who hopes to find out about this topic. You know a whole lot its almost tough to argue with you (not that I really will need toÖHaHa). You certainly put a new spin on a topic which has been written about for ages. Great stuff, just great!

หนังใหม่ชนโรง 2022

I do love the way you have framed this particular concern and it does offer us some fodder for consideration. Nonetheless, because of what precisely I have experienced, I only wish when the remarks pack on that individuals continue to be on issue and not embark upon a soap box regarding the news of the day. All the same, thank you for this outstanding point and while I do not concur with the idea in totality, I regard the viewpoint.

หนังใหม่พากย์ไทย

Howdy! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the great work!

camper trailer collision repair shop

Good post. I learn something totally new and challenging on websites I stumbleupon every day. It’s always interesting to read through content from other writers and practice a little something from their web sites.

หนังออนไลน์ 2022 พากย์ไทย ไม่มี โฆษณา

Howdy! Do you use Twitter? I’d like to follow you if that would be ok. I’m absolutely enjoying your blog and look forward to new updates.

หนังออนไลน์ 2022 พากย์ไทย 4k

Woah! I’m really enjoying the template/theme of this blog. It’s simple, yet effective. A lot of times it’s hard to get that “perfect balance” between superb usability and visual appeal. I must say that you’ve done a fantastic job with this. In addition, the blog loads very fast for me on Safari. Outstanding Blog!

ดูหนังออนไลน์ใหม่

Very well written story. It will be valuable to anyone who utilizes it, as well as myself. Keep up the good work – for sure i will check out more posts.

mobil rv repair near me

That is a great tip especially to those fresh to the blogosphere. Brief but very accurate informationÖ Thanks for sharing this one. A must read article!

the best trailer repair near by

Can I just say what a comfort to find somebody that truly knows what they’re talking about on the internet. You actually realize how to bring a problem to light and make it important. More people ought to look at this and understand this side of the story. I was surprised you are not more popular given that you certainly have the gift.

หนังใหม่2022เต็มเรื่อง พากย์ไทยชนโรง

whoah this blog is magnificent i really like reading your articles. Keep up the great paintings! You understand, a lot of people are searching round for this info, you could aid them greatly.

ดูหนังออนไลน์

you could have an ideal blog here! would you wish to make some invite posts on my weblog?

เซียนคาสิโน

I’d should verify with you here. Which isn’t one thing I usually do! I take pleasure in reading a put up that can make people think. Also, thanks for permitting me to remark!

สล็อตยอดเซียน

magnificent points altogether, you just won a new reader. What would you recommend in regards to your publish that you made a few days in the past? Any certain?

สูตรสล็อต pg สล็อต แตกง่าย

Hey there, You have performed a great job. I’ll definitely digg it and in my opinion suggest to my friends. I’m sure they will be benefited from this site.

สล็อต7

I’m really loving the theme/design of your web site. Do you ever run into any internet browser compatibility problems? A small number of my blog readers have complained about my blog not working correctly in Explorer but looks great in Safari. Do you have any solutions to help fix this problem?

สูตรเซียนบาคาร่า

Thanks for sharing superb informations. Your web site is so cool. I am impressed by the details that you’ve on this site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my pal, ROCK! I found simply the info I already searched all over the place and simply couldn’t come across. What an ideal web-site.

rv repair shop arcadia california

bookmarked!!, I love your site!

สูตรเกมสล็อตpg

Attractive section of content. I just stumbled upon your web site and in accession capital to claim that I get actually enjoyed account your weblog posts. Anyway I will be subscribing for your augment and even I success you get admission to constantly rapidly.

สล็อต7เซียน

Hi I am so delighted I found your webpage, I really found you by error, while I was looking on Digg for something else, Regardless I am here now and would just like to say kudos for a incredible post and a all round exciting blog (I also love the theme/design), I don’t have time to go through it all at the minute but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read much more, Please do keep up the awesome work.

สูตรสล็อต pg แตกง่าย

What i don’t understood is actually how you’re not actually much more well-liked than you might be right now. You are very intelligent. You realize thus considerably relating to this subject, produced me personally consider it from a lot of varied angles. Its like men and women aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs great. Always maintain it up!

Website Marketing

I could not resist commenting. Very well written!

สล็อต7

Thanks a lot for sharing this with all of us you actually know what you are speaking about! Bookmarked. Please also discuss with my website =). We could have a link change arrangement among us!

Holistic Nurses Association

Way cool! Some extremely valid points! I appreciate you writing this post and the rest of the site is very good.

Local Advertising Near Me

You made some decent points there. I looked on the internet for additional information about the issue and found most individuals will go along with your views on this site.

RV Solar Panel Installation Near Me

This is a good tip especially to those new to the blogosphere. Simple but very precise infoÖ Appreciate your sharing this one. A must read post!

หนังใหม่ 2022

This website is really a walk-via for the entire data you wanted about this and didn’t know who to ask. Glimpse here, and also you’ll undoubtedly discover it.

หนังใหม่

Can I just say what a reduction to seek out someone who really knows what theyre speaking about on the internet. You definitely know how to carry a problem to mild and make it important. More folks must read this and understand this facet of the story. I cant believe youre no more common since you positively have the gift.

ดูหนังออนไลน์ใหม่

Wow that was strange. I just wrote an very long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say superb blog!

หนังออนไลน์

excellent points altogether, you simply received a emblem new reader. What would you recommend about your post that you made a few days ago? Any positive?

หนังใหม่

Thanks for the auspicious writeup. It if truth be told was once a entertainment account it. Look complex to more added agreeable from you! By the way, how could we keep in touch?

หนังใหม่2022เต็มเรื่อง พากย์ไทยชนโรง

Thank you for the sensible critique. Me and my neighbor were just preparing to do some research about this. We got a grab a book from our area library but I think I learned more clear from this post. I’m very glad to see such magnificent information being shared freely out there.

Website Branding

I really like it whenever people come together and share ideas. Great website, stick with it!

ดูหนังออนไลน์2022

Outstanding post however , I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit more. Appreciate it!

หนังออนไลน์ 2022

Hi there! I could have sworn I’ve been to this website before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be bookmarking and checking back frequently!

เว็บดูหนังออนไลน์

Hello. splendid job. I did not anticipate this. This is a splendid story. Thanks!

ดูหนังออนไลน์

Hello my family member! I wish to say that this article is awesome, nice written and come with approximately all significant infos. I’d like to look more posts like this .

เว็บดูหนังฟรี

Youre so cool! I dont suppose Ive learn anything like this before. So nice to search out anyone with some unique thoughts on this subject. realy thanks for starting this up. this web site is one thing that is wanted on the web, someone with slightly originality. useful job for bringing something new to the web!

เว็บดูหนังออนไลน์ฟรี

I really appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

Frida Cannellos

An impressive share! I’ve just forwarded this onto a co-worker who was conducting a little research on this. And he in fact ordered me dinner simply because I stumbled upon it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanks for spending time to discuss this issue here on your internet site.

Anónimo

Howdy! This post couldnít be written any better! Looking at this post reminds me of my previous roommate! He always kept talking about this. I am going to send this article to him. Fairly certain he will have a good read. Many thanks for sharing!

Don Cicale

Hi, I do think this is an excellent site. I stumbledupon it 😉 I am going to come back yet again since I book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

Nicholle Belovs

This website was… how do you say it? Relevant!! Finally I have found something which helped me. Kudos!

Mitsubishi Forklift Rental Near Me

That is a very good tip particularly to those fresh to the blogosphere. Simple but very accurate informationÖ Thank you for sharing this one. A must read post!

RV Generator Orange County

You need to take part in a contest for one of the best sites on the web. I most certainly will highly recommend this website!

RV Shop

Having read this I believed it was rather enlightening. I appreciate you spending some time and energy to put this content together. I once again find myself personally spending way too much time both reading and leaving comments. But so what, it was still worthwhile!

เว็บดูหนังออนไลน์

Great beat ! I wish to apprentice at the same time as you amend your site, how could i subscribe for a blog web site? The account aided me a appropriate deal. I were tiny bit familiar of this your broadcast provided vibrant transparent concept

bucket truck repair shops near me

I was pretty pleased to find this page. I want to to thank you for ones time due to this wonderful read!! I definitely loved every little bit of it and i also have you book-marked to look at new information on your blog.

precious metals ira company

Incredible points. Solid arguments. Keep up the good effort.|

Long Youtube Ads

I was extremely pleased to discover this website. I want to to thank you for ones time due to this fantastic read!! I definitely loved every part of it and i also have you saved to fav to look at new stuff on your website.

เว็บดูหนังออนไลน์

Really Appreciate this article, is there any way I can receive an update sent in an email every time you make a fresh post?

เว็บดูหนังออนไลน์ฟรี

I’m still learning from you, as I’m trying to achieve my goals. I absolutely enjoy reading everything that is posted on your site.Keep the aarticles coming. I loved it!

movieallstar777.com

Thank you for the good writeup. It in truth was once a leisure account it. Glance complicated to more added agreeable from you! By the way, how could we keep up a correspondence?

เว็บดูหนังออนไลน์

My brother recommended I would possibly like this website. He used to be totally right. This publish actually made my day. You can not imagine just how so much time I had spent for this info! Thanks!

ดูซีรีย์ออนไลน์

It is really a nice and helpful piece of information. I’m glad that you shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

ดูหนังฟรี

Generally I do not read post on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, quite nice post.

movieallstar777.com

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your weblog? My blog site is in the very same area of interest as yours and my users would truly benefit from a lot of the information you present here. Please let me know if this okay with you. Many thanks!

เว็บดูหนังออนไลน์ฟรี

Hello would you mind letting me know which web host you’re utilizing? I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a lot quicker then most. Can you suggest a good internet hosting provider at a reasonable price? Kudos, I appreciate it!

เว็บดูหนังฟรี

Definitely believe that which you said. Your favorite reason seemed to be on the net the simplest thing to be aware of. I say to you, I certainly get irked while people think about worries that they plainly do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side-effects , people can take a signal. Will probably be back to get more. Thanks

เว็บดูหนังฟรี

whoah this blog is fantastic i love reading your posts. Keep up the good work! You know, a lot of people are searching around for this info, you can aid them greatly.

ดูหนังออนไลน์